How to calculate the return on investment (roi) of a.

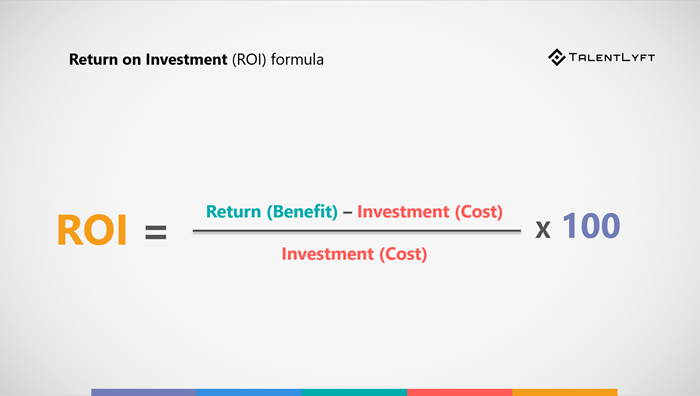

Roiformula. gains cost cost roi = calculating roi. hr measurements/ metrics hr analytics roi. training roi example. reorganization roi example. compliance roi example. compliance roi example. title: slide 1 author: tuccito created date: 10/29/2010 9:15:29 am. And return on investment is the net profit divided by the initial cost. then, to show it as a percentage, multiply by 100. here’s the formula: roi = (final value of investment initial cost of investment) x 100 initial cost roi formula example of investment. example of an roi calculation.

Return On Investment Roi Formula Example Analysis

The return on investment formula is calculated by subtracting the cost from the total income and dividing it by the total cost. as you can see, the roi formula is very simplistic and broadly defined. what i mean by that is the income and costs are not clearly specified. Mar 9, 2021 return on investment is a key financial ratio that measures the gain from an investment relative to the amount invested. you can calculate roi by . Return on investment analysis. while the return on investment formula provides helpful information about the viability of a project or investment, it does not necessarily tell us everything we need to know. there are other calculations that can be paired with the roi formula to give a better status update on an investment. Time-period basis: an implication surrounding the use of time-series roi formula example data in which the final statistical conclusion can change based on to the starting or ending dates of the sample data. the.

Calculating simple roi. the most basic way to calculate the roi of a marketing campaign is to integrate it into the overall business line calculation. The return on assets ratio (roi), serves as a profitability measure to evaluate a project or investment by dividing its net profit by the investment cost. Roi shoes_business = (2800-2000) * 100 / 2000 = 40%. so, through roi, one can calculate the best investment option available. we can see that investor book more profit in the business of shoes as the return on investment is the shoe business is higher than the bakery business.

Return On Investment Formula Step By Step Roi Calculation

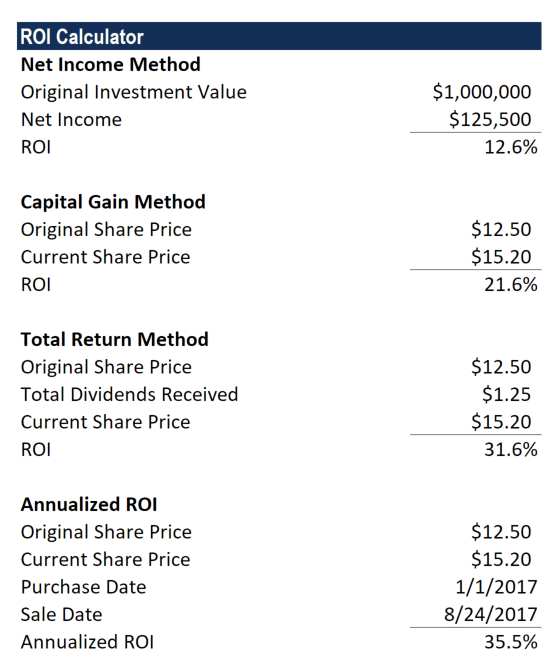

build a free online calculator for you for example, let’s say you want to calculate your net worth simply visit the page for our free net worth calculator and it will let you instantly calculate your net worth and also gives you the net worth formula and the net worth definition let’s say Roi = \dfrac {9000} {7000} = 128. 57\% roi = 70009000. = 128. 57%. in this case, the return on the investment would have a 1. 2857 or 128. 57% roi. because of these formulas, maria can see that her new campaign was a fairly good investment since it was able to generate income above the investment. Return on investment (roi) example. assume an investor bought 1,000 shares of the hypothetical company worldwide wicket co.

What Is Return On Investment Roi Definition Examples Airfocus

In this case, the net profit of the investment ( current value cost ) would be $500 ($1,500 $1,000), and the return on investment would be: roi example roi formula example 2. a company spends $5,000 on a marketing campaign and discovers that it increased revenue by $10,000. in this case, the return on investment would be: roi example 3. Example 1: let us consider the problem. a person makes an initial investment of 50000 and the his return amount (earnings) is 80000. solution: we can calculate the return on investment (roi) % using the given formula. If there is a loss, the formula will yield a negative number. here's a simple example: roi = -1,000 / 5,000 * 100. roi = -0. 2 * 100. roi = -20%. formula for shareholders and example.

Roa formula / return on assets calculation. return on assets (roa) is a type of return on investment (roi) roi formula (return on investment) return on investment (roi) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. it is most commonly measured as net income divided by the original capital cost of the investment. Analyzing the roi. the higher the return on investment, the better. the management may use benchmarks in evaluating the roi. for example, say in a particular industry, the average roi is 20%. if the subunit's roi is 8%, then that is not even half of the acceptable rate. Return on investmentformula. return on investment is typically calculated by taking the actual or estimated income from a project and subtracting the actual or estimated costs. that number is the total profit that a project has generated, or is expected to generate. calculating the roi of a project: an example. Misrepresenting your investments with the roi formula is easy. for example, stocks can have an inflated roi. there are often transaction fees and similar .

Return on investment (roi) measures how much money, or profit, is made on an investment as a percentage of the cost of that investment. to calculate the percentage roi for a cash purchase, take. Roi = \frac {\text {net\ return \ on \ investment {\text {cost \ of \ investment\times 100\% roi = cost of investmentnet return on investment. × 100%. second method: r o i = f i n a l v a l. Example of the roi formula calculation. an investor purchases property a, which is valued at $500,000. two years later, the investor sells the property for $1,000,000. we use the investment gain formula in this case. roi = (1,000,000 500,000) / (500,000) = 1 or 100%.

this term before and may even know the formula for determining your roi on a particular financial investment but for these Return on investment (roi) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. it is most commonly .

He also invested $2000 in the shoe business in 2015 and sold his stock in 2016 at $2800. then roi formula will be as follows:-roi shoes_business = (2800-2000) * 100 / 2000 = 40%. so, through roi, one can calculate the best investment option available. Here are two ways to represent this formula: roi = (net profit / cost of investment invested $5,000 in the company xyz last year, for example, and sold your shares for $5,500 this week. Return on investment (roi) is a popular profitability metric used to evaluate how well an investment has performed. roi is expressed as a percentage, and is calculated by dividing an investment's. Guide to return on investment formula. here we discuss how to calculate roi using practical examples along with downloadable excel templates.

Return on investment (roi) definition.